Free Money 'Replaced Almighty Dollar'

In a recent article, I asked "Will the demise of the US Dollar usher in Free Money?" Voices of the imminent demise of the Dollar have been with us for years, but for now the currency holds on.

So instead of speculating on the timing of the dollar's demise, let's take a look into the (possible) future. Silvano Borruso, the Italian teacher working in Kenya who wrote the "free money" part of the recent article mentioned before, has taken a look into his crystal ball. He sees that the demise of the almighty dollar and especially of the huge bubble of purely financial values it has promoted does not automatically mean the destruction of the real economy of production and exchange.

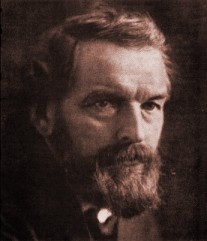

Silvio Gesell - Image credit: Cooperative Individualism

If we only heeded the words of Silvio Gesell, German-Argentinian business man, monetary reformer and economic thinker ahead of his time, and if we followed the example of mayor Unterguggenberger of Worgl in pre-WW II Austria, says Borruso, we would be better off for it.

Day-dreaming of times to come, Borruso then outlines how our economy would change were we to introduce "free money". In accordance with existing models of local or regional currencies, free money can be issued by any economic player or group. The money would be interest-free because it is created as a credit, rather than as debt. It would circulate faster than any money we have now because of a special feature called demurrage, which means that hoarding currency would be subject to gradual loss of value. So "free money" would be different from what we have today in that it would no longer serve the "store of value" function. That function, today expressed as monetary savings, would have to move into investments in real values or useful things. Such a change would make our economic universe look quite different.

Anyway, let Silvano tell you how he sees our monetary and economic future...

- - -

... as long as money - any money - still carries the contradiction "store of value" v. "means of exchange" it will not be possible to avoid injustice. Money has to be, as the late Prof Auriti put it, like blood: it starts at the heart and returns to it, after having served every single cell of the body. No organ, tissue or cell "owns" blood. The moment blood stops from circulating it is a haematoma, septicemia, and death. Silvano Borruso

DEMISE

"Apocalyptic" is an oft-used word to denote the imminent denouement of the global economic/financial situation. But before cold sweat begins to drip down your eyebrows, let me remind you that "apocalypsis" does not mean "catastrophe unlimited:" it means "revelation." Let me begin therefore by revealing (or take a look if you have the book) Gross' cartoon that appears on page 120 of Bernard Lietaer's The Future of Money.

A disconsolate man, his face stuck between two bars of a cage, peers through them. He looks in that one direction. But the cage has no bars other than those two. Were he to look beside, or behind, him, he would be free. It is a good picture of our current predicament.

On page 17 of the same book there is another cartoon, this time by Cardon: a shackled, sitting man painting his shackles instead of hack-sawing through them. All currency reformers except Gesell (1862-1930) have consistently failed to see that a medium of exchange endowed with intrinsic value must be inherently unable to serve an economy, but inherently (and successfully) able to control it, which accounts for today's mess. Would be reformers have tried the impossible: prevent the control of the currency without taking away from it its function as store of value. They have been painting shackles.

Hack-sawing is mentally easy, but physically exhausting. Stripping a medium of exchange of its function as store of value is physically easy, but mentally exhausting. Switching paradigm from a money-driven economy to a work-driven one is a hard and demanding mental effort, but the result is exhilarating. Let us proceed in order.

Today's scenario is that the world economy of production and exchange, which could easily be served by three-odd trillion dollars, is instead controlled by an immense financial bubble growing by feeding on itself, and worth 150-plus trillion. Clearly the situation is unsustainable. The question is not if, but when the bubble is going to burst. But the point is that when it bursts, the economy of production and exchange will still be there, intact, as in 1987 when one trillion dollars disappeared in a puff and the real economy hardly noticed it.

The monetary disorder of the past 3 000-odd years, unleashed by King Croesus' unfortunate decision of monetizing gold, has spawned a mindset of superstitions, e.g.

• "To be rich" means "to have money;"• "Hard money" is money with a mysterious ingredient called "intrinsic value;"

• "Rich countries" are the only ones where one can pursue "the American dream;"

• There is no other way of raising public revenue than either taxing or borrowing from banks;

• To invest, one must have "saved money" first;

• Credit is money;

• For a country to develop, it must borrow money from where the money "is."

• "Cheap" = costing little money; "Dear" = costing a lot of money

Etcetera. With this mindset it would take many pages to show up the falsity of the above propositions. On grasping the concept of Gesell's Free Money the same falsity stands out at once, as does the remedy.

To understand, let us flash back to the little town of Wörgl, in the Austrian Tyrol.

The time is July 1932, in the thick of the Great Depression. The Austrian National Bank, following the directives of a group of central bankers meeting in Washington in 1927, had engaged into a policy of deflation without informing the public.Michael Unterguggenberger (1884-1936), the mayor of Wörgl, was no economist, but he had read Gesell during the semi-poverty caused by the crises of 1907-08 and 1912-14, during which he had contracted the TB that would lead him to the grave at 52. He knew the remedy, and set to work.

Money was scarce, industries were closing and unemployment was rampant. The 1 500 unemployed of Wörgl (out of a population of 4 000), were knocking in vain at the mayor's door for help.

After patiently briefing small entrepreneurs, shopkeepers and professionals of the town, on 5th July he declared:

"Slow circulation of money is the principal cause of the faltering economy. Money as a medium of exchange increasingly vanishes out of working people's hands. It seeps away into channels where interest flows and accumulates in the hands of a few, who do not return it to the market for the purchasing of goods and services, but withhold it for speculation."

These words have lost not an iota of relevance, with the only proviso that what accumulates in the hands of a few today is not a trickle of banknotes, but the gigantic bubble described earlier.

The municipality issued its Bestätigte Arbeitswerte (Certificates of Work done) at par with the official Schilling.

In so doing, Unterguggenberger had no idea that he was correctly defining money for the first time in history. "Certificate of work done" is what money should have always been, but was prevented by Croesus' multiple incantations. When it comes to defining money, economics textbooks, manuals, treatises, and learned tomes offer up to four separate definitions of money's functions, blissfully unaware that four definitions are no definition, in other words that money is endowed with functions that it should have never been endowed with.

Every certificate (the object representing the monetary unit) expired after a month unless a stamp worth 1% its nominal value was affixed to it to keep it circulating. The stamps could be purchased at City Hall, which in turn accepted the certificates in payment of taxes.

Let us take stock. This feat could be painlessly repeated by any municipality in the world right now, without having to wait for the bubble to burst. What would its most difficult step be? Without doubt, the briefing: convincing people that the only function of a lubricant is to lubricate and therefore to circulate, not to stagnate in one's pockets, under mattresses, or in banks.

No one was obliged to accept the certificates. The alternatives were:

• Deposit them in the municipal bank at 0% interest. The bank, in order not to pay the demurrage charge, got rid of the certificates at once, either by lending them or by paying for salaries and invoices for public works.• Exchange them with official Schillings at a discount of 5% on the nominal value.

The municipality printed 32 000 units of certificates, but in practice issued less than a quarter of them. Circulation averaged 5 300 units, i.e. a derisory two Schillings or less per person, which however gave work and prosperity to Wörgl and environs far more than the 150 Schillings/person issued by the National Bank of Austria. As Gesell had predicted, velocity of circulation was what mattered: changing hands some 500 times in 14 months, against the 6 to 8 times of official money, 5 300 units of certificates moved goods and services for 2.5 million. City Hall, by emptying its coffers as fast as citizens' taxes filled them, built a bridge on the Inn, tarmacked four streets, repaired sewerage and electric installations, and even constructed a ski-jump. To have an idea of purchasing power, the mayor's monthly salary was 1 800 Schillings.

At the beginning some smiled, others cried foul or suspected counterfeiting. But prices were not going up, prosperity was increasing all round, taxes were being paid promptly when not in advance, and immediately re-invested in public works and services or paid out in salaries and municipal purchases.

Sneers soon turned into jaw-dropping, and jests into desires to imitate. Early in 1933, the 300 000 citizen of the Tyrol and Kufstein were about to extend the experiment to the whole province.

Meanwhile Wörgl had become a centre of pilgrimage for European and American macro-economists. All were eager to see the "miracle" of local prosperity defying global unemployment and stagnation. Did they go to learn? It is doubtful, given the most complete silence about Gesell in the faculties of economics.

Mammon did not sleep. Unterguggenberger had wisely refrained from calling his certificates "money," for he knew that by doing so he would have incurred the ire of the National Bank.

On 19th August 1932 Dr Rintelen, on behalf of the Austrian government, received a delegation of 170 mayors headed by Unterguggenberger. He had to admit that the National Bank had deliberately reduced the emission of official money from an average of 1,028 million Schillings in 1928 to one of 872 million in 1933. He also had to admit that the certificates made sense and that there was no valid reason to interrupt the experiment.

But Mammon had his own "scientists" at the National Bank, intent on "proving" that the experiment had to be verboten. Here are their "scientific" reasons:

"Although the issue of relief money appeared fully covered by an equal amount of official Austrian notes, the supervising authorities, starting with the area administration in Kufstein and following with the government office of Tyrol, must not allow themselves to be satisfied.(emphasis added) As a matter of record the borough of Wörgl has exceeded its powers, since the right to issue money in Austria is a privilege of the National Bank. This is stated in Art. 122 of the bylaws of the Austrian National Bank. Wörgl broke that law."

The last statement is false. Wörgl did not break the law. What its certificates, fully backed by official money, had done, was what the Sorcerer's Apprentice had done with his broom: multiply the number of units so as to match their circulation to the needs of the real economy. Conventional money is designed to prevent that, not to favour it.

The prohibition went into force on 15th September 1933. Wörgl appealed. The case reached the Supreme Court, which faithful to Mammon quashed the appeal and ended the experiment.

Unemployment, poverty and hunger returned. An obscure Austrian immigrant had begun to attract attention in the Bavarian Bierhalls: Adolf Hitler. It is impossible to affirm, or to deny, that the Second World War could have been avoided by listening to Gesell. It is a fact that Hitler rose to power with the votes of the unemployed.

Analysing the Wörgl experiment permits us to break the spell of the incantations:

• Free Money makes it impossible to live off the work of others. Its exclusive function (medium of exchange) makes "rich" not him who has money, but him who has (non-financial) skills. Parasites either get the ravens to bring them food or starve.• Money loses all adjectives: "hard", "soft," "strong," "weak," cease to have meaning; money is just money; the "intrinsic value" of the Wörgl Certificates was nil.

• The American Dream can be pursued anywhere, the closer to home the better;

• "Raising public revenue" meant that the citizens deposited their surpluses into the public coffers at 0% interest, and the public authority spent them into whatever it saw fit; for capital public expenditure, i.e. infrastructures that created new wealth, Wörgl was not given time to introduce new money to match the growth of the economy. Had it continued, this step would have become necessary. Put it another way, taxing and borrowing (directly from the public, not from the banks) were unified into one single operation. The municipal bank doubled up as revenue collection centre. Were Free Money to be introduced at State level to kick-start a new monetary system, the fourth function of Government would stand out: issue new money when prices flag and withhold it when they rise.

• To invest, i.e. to dispose of large sums of money in one instalment, one borrows it. Free Money makes it more attractive to lend at 0% than to hoard at -6%. One asks for one's money back if and when needed.

• Credit becomes redundant. Credit was spawned into existence by the chronic dearth of medium of exchange. With this as abundant as work done by definition, credit ceases to be of use. Credit is deliberately confused with money precisely by the forces that control it.

• For a country to develop, it has to issue as much Free Money as to satisfy the equation FM x velocity of circulation = labour x materials.

• "Cheap" = done with little labour; "Dear" = done with a lot of labour.

For a longer list of advantages of Free Money (FM), see Gesell at www.utopie.it. Our attention must now turn to the modalities of introduction. When to introduce FM? How? Who should do it?

FM, as a matter of fact, has already been introduced, but without being called FM. I do not refer to the 30,000-plus community currencies, since only some of them function on Gesellian principle. FM is around as Frequent Flyer bonuses and as Telephone Credit units. The first are issued by airlines and the second by telecommunication companies. They are currently used as supplementary currencies in airports, where one can buy small consumer items besides telephone time and passenger/miles. Both these devices make use of the Gesellian principle of demurrage, for they expire if not spent after a certain date. Demurrage is already familiar to lots of people.

Frequent Flyer bonuses and telephone credit units can answer the question, "who can issue FM?" The answer is "anyone who produces wealth (goods and services) of any kind that can be readily monetized." Two examples follow.

The first is still potential, but could be actualized any time. A school teaching period is a natural unit of wealth, in terms of value added to human capital. It has the same worth anywhere in the world and at any time imparted, primary, secondary or university level. Yet its monetization depends today on external sources, i.e. the perennially scarce medium of exchange with its contradictory double function. A good example of such is four major slums around Nairobi City: Kibera, Kawangware, Mukuru and Mathare. No one knows their total population, but they harbour 1,000 private primary schools, with a staggering student population of 350,000. The fees are a paltry 10 shillings/day, paid daily by those who manage to scrounge ten bob somewhere. There is an educational consortium already in place. Were they to monetize their immense potential, on Gesellian principle, they would see the slums become engines of development in next to no time.

The second is a lost opportunity: the Channel Tunnel. This piece of superb engineering took seven years to build, 1987-1994. The original estimate was seven billion pounds, which various hitches jacked up to thirteen. Eurotunnel is almost bankrupt because it had to go into debt with a consortium of 220 banks, with the result that its rates cannot compete with those of the ferries. In regime of Free Money, Eurotunnel could have issued travel bonuses denominated in passenger/km and tonne/km, for the paltry value of two million pounds in 1984, which by changing hands 500 times in seven years would have paid for the works without indebting anyone, at the original estimate. FM could also have been issued by H.M. Treasury, with the same result.

Eurotunnel bonuses would have circulated, returning to Eurotunnel's offices as purchased tickets; H.M. Treasury's FM would have returned to the Treasury as tax.

I am fully aware, of course, that H.M. Treasury's capacity to issue Free Money entails the demise of the Bank of England. As things are, this is a very tall order. Nobody has the power to take on an institution that has called the shots for more than 300 years.

But things are today what they may well not be tomorrow, for tomorrow the bubble is going to burst, and the B.O.E. with it. Let us peek into the likely scenario.

There are 129 messages in my junk e-mail folder (despite server's protection against such), about 70% of which are frantic requests to buy fabulous shares, one of which claims 49% in two days (!). It is obvious that the sellers are already desperate to get rid of worthless pieces of paper by enticing fools into believing the opposite. Well, when the bubble bursts, millions (this is a guess: perhaps only hundreds of thousands, but no matter) of such people will come to market to buy things with the first "money" that blurts out of the bubble. They will send prices sky-high, and the world will be strewn with gaudy, but worthless, pieces of paper.

The economy of production and exchange will not collapse. Only the financial system will. It would be the height of folly to repaint the shackles with a "system" containing the same seeds of disorder and ultimately of destruction as that spawned by Croesus three millennia ago. Gesellian money will appear as a must to the eyes of the most stubborn of sceptics. How will the world react?

Those communities already on Gesellian principle will readily see that their monetary units are not worth the thousands of worthless dollars offered them by the fugitives from the bubble. They will invite such people to exert themselves in some useful work and pay them with their money. The community will benefit from an increase in human capital of parasites-turned-workers (hunger will see to it that the transformation is rapid enough).

Those, whose mental inertia has left them unprepared for the shock, will panic, but temporarily. If they have goods and services to sell, they will quickly see that the increasing amounts of conventional money offered them would make less and less sense, until sales stopped and the need for a genuinely new monetary system could no longer be avoided.

Some of the fugitives will be government people. Necessity, mother of virtue, will finally convince them that money must be what it was always meant to be, stripped of the brocade of "intrinsic value" that Mammon had dressed it up with for so long. The fourth branch of government will place people firmly in control of their own money once and for all.

The first country to adopt Gesell would conquer the world, not militarily of course but economically and culturally. And Lord Acton (1834-1902) will be vindicated: in the final struggle of the people versus the banks, which he foretold more than 100 years ago, the people will have swept the enemy into the dustbin of history.

Silvano Borruso

silbor@strathmore.ac.ke

18th July 2006

- - - - -

A POST-MAMMON WORLD

A day-dream

The year is 20... The bubble burst ...years ago. Erstwhile billionaires have seen their billions change into... actually they haven't. They have seen them for what they really were all along: computer entries at times appearing in black and white thanks to a few micrograms of ink on paper. The illusion that to be rich means "to have a lot of money" has vanished, as has the bubble. Now he is rich who has know-how, the more diversified the better. As Greek wisdom had it, "the wise man carries his wealth inside himself." This is now the reality.

In the wake of the tens of thousands of communities issuing their successful Free Money currencies since 1982, one country after another has adopted Free Money too. Its store of value is zero, but it functions flat-out as domestic medium of exchange. It is totally useless for foreign trade, which in any case has been cut down to size. Countries are catching up on domestic production, once again giving pride of place to agriculture followed by industry. The oxymoron "financial industry" is no more.

From an economy of scarcity the world has passed to one of abundance. Prices are the real ones, not burdened by an impossible amount of usury. Only countries with excess domestic production are thinking of foreign trade. If they need some foreign product, they barter it for whatever surplus they have. If they have a surplus but no needs, they give it away to anyone willing to pay the transport costs. And if they have needs but no surplus, they browse the Net for whatever is offered free of charge somewhere.

Money manipulation, speculation, unemployment, booms and busts and crises of all hues are nightmares from the past. Everybody works, enjoys leisure, and saves for old age, but only in case he becomes unable to work. If he doesn't, willingness to work always pays. Everyone, from 8 to 80+, is paid cash on the nail for any work, however menial. Even school children are rewarded for work well done, which has put wings to their academic performance. Workers no more wait for "the end of the month," no one "hire purchases" anything anymore, I.O.U.s and stuff that made life unbearable in the days of scarce store-of-value money have disappeared. With Free Money

Demand is inseparable from money; it is no longer a manifestation of the will of its possessors. Free Money is not the instrument of demand; it is demand itself, demand materialised and meeting, on an equal footing, supply, which always was, and remains, something material. The "tone" of the Stock Exchange, speculation, panic and collapse cease from now on to influence demand. The quantity of money issued, multiplied by the maximum velocity of circulation possible with the existing commercial organisation, is in all conceivable circumstances the limit, maximum and minimum at the same time, of demand.Quoted from Silvio Gesell's Natural Economic Order, Part IV, Chapter 4

The parasites that used to manipulate money in order to make more of it have either disappeared or are in the process of disappearing. Those who earn their bread by the sweat of their brow have seen their activities deeply modified by Free Money. For instance:

The independent craftsman and small shopkeeper have returned, at the expense of the corporation and the humongous mall. This feat seemed impossible before the bubble collapsed, but let us reflect: what ousted the small economic operators?

Independent craftsmen could not compete with the corporations because they were forced to deliver their products on credit. They could not wait; the corporation could. Now that credit is gone, prompt payment is all that is needed to usher their renaissance.

Small shopkeepers could not compete with the malls for a different reason: purchases in small amounts, forced on the buyers by the perennial dearth of medium of exchange, could more conveniently be undertaken in a single location (super-, hypermarket, mall) instead of being scattered among many shops. Free money has changed all that: people are now more prone to buy in bulk and store non-perishable items at home instead of buying them in retail shops, which are disappearing anyway.

Shops in fact have not increased in number: they have decreased. Where formerly there were ten shops now there is hardly one, with a tenfold increase in turnover but requiring less labour to run than formerly. Shopping time has also decreased; home storage is now prevailing. Perishables are stored if and where people have the right facilities (refrigerators etc.).

Middlemen, travelling salesmen, sales agents of all sorts are no longer. They existed because high retail prices with huge mark-ups, even for daily necessities, made it difficult to sell such items to those whose wage increase was a fourth or fifth of the mark-up. One had to sacrifice certain items if one wanted to buy others. The salesmen were there to prod, cajole or con the switch. Now that everyone has enough for the necessities, saving for extras is no longer a problem.

Most banking establishments have closed. Bills of exchange and cheques, which used to keep cashiers working overtime, have but disappeared. For why did they exist? Because there wasn't enough cash. Now that cash is as abundant as the number of exchanges by definition, there is no need of instruments of credit of any sort. The credit card, touted to have ushered the "cashless society" has been seen for what it was: a usurious scam, which on top of it all made it possible to track the personal movements of the holder. The amount of cash to handle is just what one needs; what comes in goes out at the same rate.

Terms like "securities," "solvency," "clearance," "guaranteed cheques" and like jargon have become obsolete.

Shopkeepers take stock weekly, and on Friday evening calculate whatever depreciation they have incurred because of demurrage and log it in their expenses. It is much cheaper than what they formerly paid in bank charges. And nine out of every ten cashiers have become redundant. They now engage in production, each finding a particular niche in the market for what he can produce.

Free trade is now a reality, for everyone is now free, not just the corporations. The State has no more need for deploying an army of customs officials to plunder travellers like the robber barons of yore. People pay taxes promptly, even in advance, and the money is immediately spent. Public expenditure for productive purposes increases physical capital and wealth with it; the Currency Office backs it up by issuing the extra money needed. Public expenditure for unproductive purposes (salaries of civil servants) is also immediately spent, but privately, not publicly. And the need for extra civil servants who do little beyond keeping their seats warm at their offices is gone. Now those who work for the State do work, and there is not one more or one fewer than needed.

The global acceptance of Free Money has made possible not only Free Trade, but also stable foreign exchange and stable home prices, three targets forever unattainable with Store-of-Value Money.

Manufacturers enjoy what they had always wanted but were frustrated from getting: steady, assured sales with long-term orders in advance. They no longer need to overextend themselves under the dictates of compound interest. Regular sales, cash payments and stable prices is all they want, and now have. They no longer need to dismiss labour when the economy slackens, because the economy neither slackens nor "heats up." Production attains equilibrium with population growth and keeps pace with it.

They no longer have to "plan" their production: the buyers plan it for them. Buyers let their needs be known to manufacturers well in advance, and are even ready to make advance payment. Changes of fashion are demanded from below, not imposed from above under the diktats of usury.

Creativity has shifted from commerce to production. Manufacturers no longer have to double as commercial managers, for the science of "marketing" is no more.

Usurers and speculators are extinct species, as are counterfeiters. As no large amounts of money are to be found stashed anywhere, and as velocity of circulation has replaced sheer quantity, counterfeiting has become unprofitable. Too much work is involved for something that is not in demand.

Working has become more profitable than stealing. Among other things, anyone with a large sum of money not intending to spend it in a large purchase, becomes suspicious immediately.

Savers are another kettle of fish, although the mode of saving is today vastly differs from what it used to be. A saver deposits a sum in his bank, and the bank undertakes to give him the same sum back at 0% interest, minus a small fee for services rendered. But that money does not stay in the bank. It circulates, making wealth move fast in the form of goods and services. Put it another way, banks now do what they have always pretended to do but did not: lend their depositors' money, at 0% interest minus a small fee for services rendered, i.e. salaries and overheads.

A saver no longer needs to "dig" into his savings at the threat of a slump, and of unemployment. He will dig into them only if he needs to withdraw enough to buy a car, a house, a trip abroad and similar.

Formerly, a worker who earned 1,000/year could save, say, 100/year. At 4% compound interest he would get 3,024 in 20 years. Now his wages have doubled to 2,000, but his needs haven't. He can save the former 100 plus 1,000, or 1,100. In 20 years at zero interest his savings amount to 22,000. He can afford things he formerly couldn't.

No one is now in a position to live off interest, but everyone is able to live off the fruits of one's labour, and labour, whether manual or intellectual or both, always produces an income, so that there is no need to bequeath monetary inheritances to one's offspring. Fixed assets are enough.

Formerly workers used to go out looking for work, i.e. money. Now it is the other way round: money goes out to look for workers. But there is a problem: past population control policies, abortion and other practices dictated by usury have created a huge shortage of people, and hence of labour. This shortage is biting hard. To add insult to injury, foreign workers have all gone home. The moment their countries adopted Free Money, prosperity returned, and so did they, who now put a shoulder to the wheel of their countries' economies. Now the real power of a country can only be measured in terms of population. This was always true, but now it is obvious.

Store-of-value money inserted a time lag between purchase and sale, dictated by interested delay, greed for gain and thousand other forces external to exchange. Now Free Money brings goods together, forcing purchases and sales into following closely on one another. Proudhon has been vindicated: store-of-value money used to act as the bolt that bars the gates of the market; Free Money is the key that makes it possible to fling them wide open.

See also:

American Monetary Institute

The independent study of monetary history, theory and reform

How a Circulation Charge Can Help Save and Transform Global Finance

Today, as members of the G20 and architects of the global Bretton Woods II convene to consider new financial instruments for building the 21st century economy, a circulation charge should be at the top of their list. A validation fee of this sort addresses the essential design flaws of the current economy that make it utterly impossible to reconcile finance with environmental sustainability and the alleviation of poverty. These flaws include compulsive exponential economic growth in a world of finite resources, the myopic discounting of the future and a regressive redistribution of wealth into the hands of the world's wealthiest via the interest on money.

A circulation charge effectively goes to the root of these problems by changing the qualitative nature of how we hold money. It inherently shifts financial thinking towards longer time frames. It creates a natural incentive to lend money without the need for interest, which would mitigate compulsive exponential growth, lessen the costs associated with borrowing and investment and reduce social disparities. It is precisely by shifting these central financial dynamics that markets can naturally begin reversing the inequalities between the rich and poor, facilitate investments in alternative energy infrastructure and create a more resilient financial system.

Comments

September 22, 2006 4:05 PM | Posted by: abc

Remember that the wörgel system had one major bug!

Its existence and value depended on the "national" money, not so the gogos and its successors.

March 1, 2007 4:22 PM | Posted by: Dugan King

Great article Sepp. I have a political solution. A few years back I wrote the U.S. Money Amendment which does exactly what you are promoting. I have never shared it with anyone for fear of some type of retribution by the Rothschild Global Money Syndicate, the Beast which controls the world's current systems of debt money. Let me know what you think.

The United States Money Amendment

For the purposes of this amendment, money is defined as any uniform increment, token, note, receipt or other recorded evidence given as proof or credit for work performed and accepted in trade as legal tender.

It is hereby declared that the public credit of the United States, which accounts for the total output of our national workforce, is the exclusive property of the People of the United States and shall never otherwise be owned, issued, regulated or controlled by private individuals, corporate bankers, foreign investors or private profiteers of any kind. Therefore the power to grant and control the public credit of the United States shall be vested permanently and exclusively with the People of the United States, acting through their elected representatives and none other.

The full faith and credit of the United States is hereby established as the permanent basis for all legal tender issued as money and circulated as a medium of exchange in the United States.

All federal, state and territorial republics of the United States shall hereafter establish public owned credit institutions with financial powers to create, issue, loan, regulate and control an interest free medium of credit money. The primary aim of these credit institutions is to stimulate and facilitate the work, trade and prosperity of the People of the United States and to further secure their safety, happiness and general welfare.

Once these public credit institutions are duly established, they shall immediately act to remove all Federal Reserve Notes from circulation and extinguish all legitimate forms of public indebtedness by redeeming them with interest free credit money. Thereafter, every form of taxation and public indebtedness within the United States shall become redundant and forever abolished.

In lieu of taxing and borrowing, all public credit institutions herein established shall create and issue the new credit money, but only to pay for public works performed in the public interest and to make interest free loans to all creditworthy Citizens of the United States and for no other purposes.

In order to establish a standard of value for all credit money issued in the United States, the President and Congress shall occasionally fix and determine a minimum wage for one hour of unskilled labor.

All Federal Reserve Banks created by the Federal Reserve Act of 1913 are hereby abolished and said Act, including all its subsequent revisions, is hereby repealed.

The Internal Revenue Service created by the 16th amendment to the Constitution of the United States is hereby abolished and said Amendment, with all its subsequent acts and revisions, is hereby repealed.

All offices under the Federal Reserve System and the Internal Revenue Service, whether public or private, shall be immediately closed, their assets frozen and their books and records preserved for an audit and investigation by the President and the Congress of the United States in order to expose and punish any criminal acts.

March 1, 2007 7:07 PM | Posted by: Sepp

Dugan,

I think your amendment is a good start.

And not to worry about retaliation by the Global Money Syndicate - all we're doing is discussing theoretical possibilities ...

What needs to be incorporated, either into the amendment or into the details of how this is to be run, is a mechanism that allows the amount of credit in circulation to be adjusted to what is right for the economy. If we hypothesize that every time money is needed for expenditures of the state, money is created, we will end up with an eternally growing amount of money in circulation, as new money (credit) is continually added to the existing total by government spending.

As a consequence of public spending, the total amount of money (credit) in circulation grows. This is no problem, as long as the amount of goods on offer also grows. In times of reduced or level economic activity, there will be a need for a mechanism that allows the money supply to be reined in. In fact, you say that the public interest money institutions should not only be able to create, issue and loan but also to "regulate and control" that interest-free money.

Stability of prices depends on an equilibrium between supply (goods) and demand (money). A steady increase in money mass would, therefore, lead to demand (money) outstripping supply - goods on sale - resulting in an ever increasing, and eventually quite disruptive, trend towards inflation.

In the historical example discussed in the article, such a mechanism was introduced as follows:

"Every certificate (the object representing the monetary unit) expired after a month unless a stamp worth 1% its nominal value was affixed to it to keep it circulating. The stamps could be purchased at City Hall, which in turn accepted the certificates in payment of taxes."

So money was subject to a regular, monthly, tax of one per cent of its value. That tax on the money - which may also be a different percentage - provides a means to adjust the total of money in circulation, in order to avoid the inflation normally associated with an excess of liquidity.

If more money is needed for a growing economy, increased spending will provide it. If less liquidity is desirable, reduced spending, combined with the tax on the money - demurrage is the technical term - will reduce the amount of money in circulation.

March 9, 2007 7:46 AM | Posted by: Dugan King

Dear Sepp, You are absolutely right. A stable money supply must remain elastic and capable of expanding or contracting in tandem with the productivity of the workforce. The proposed U.S. Money Amendment allows for this elasticity without any need for taxation or charges for demurrage. The amendment authorizes only two methods of creating money, by direct spending for public works projects or by interest free lending to private persons and enterprises. Direct spending for public works creates a base money supply which remains in circulation permanently and grows as roads and bridges grow. The interest free lending operation creates a secondary money supply which circulates temporarily until the principal is repaid. By turning the credit spigot off to counter inflation or on to counter recession, the money supply can easily be adjusted to maintain a stable value for goods and services produced. By tightening credit so that old loans are repaid faster than new loans are made, the money in circulation can be reduced to counter inflation. And vice versa for recession. We have Occam's Razor working here. Imagine an economy where usury and taxation are completely abolished. Multiply all that retained wealth by every hard working, credit worthy Citizen and our world would look very different. The legal adoption of the U.S. Money Amendment would end the reign of the Invisible Beast (a.k.a. Mammon a.k.a. Rothschild a.k.a. Great Britain) and usher in a new era in world history. Should we do it?

March 9, 2007 9:46 AM | Posted by: Sepp

I have some problems with your proposal.

First of all, isn't credit used right now as the regulating mechanism to "control" the money supply, with more than dubious results?

By what mechanism do you propose credit should be tightened. Today that is done with interest rates hikes. What is your mechanism, seeing that your loans are interest free?

You say no taxation ... but what if government spending which creates more money exceeds the need for money in circulation and tightening credit does not provide a sufficient mechanism for regulation? Have you ever seen a financially prudent government?

It seems that you must re-think your proposals before you get too carried away.

March 13, 2007 8:45 PM | Posted by: Dugan King

Dear Sepp,

I have already put a lot of thought into the U.S. Money Amendment. I believe it is mathematically rigorous as it stands. I have picked at it for quite some time and I think it is a much better mouse trap than what we have currently. I have been researching this issue for more than 25 years. The questions you pose are not difficult to answer. The issuance of credit in the United States is all done by the Federal Reserve Bank of New York which is a private bank owned by a handful of related New York member banks which are part of the global pyramid. This is where credit originates out of thin air. Inflation is currently countered primarily by reducing or contracting the volume of lending. Raising interest rates is a secondary tool to help keep the volume of loans down by making it more expensive, but it is not as workable as simply reducing the volume of lending. Since my proposal abolishes usury and interest payments, countering inflation under my proposal would be done only by the primary means of reducing the volume of new loans. That would be more than adequate. The dubious results we are getting from the current method are due to the fact that big bankers are parasites who make insider profits by churning the market to purposely create cycles of inflation and recession. By removing these profiteers from the equation and de-centralizing the issue of credit, I think we can minimize those dubious results. If government spending is limited to public works projects such as roads, bridges, public administration, public safety, etc. and the money is spent only as the work is done, the issue of credit would be redeemed by the value of the work performed. That issue of work redeemed credit would stay in circulation permanently as the basic foundation of the money supply. It would only grow as roads and bridges grow. But then, when the government lends its credit to private individuals and businesses, free of interest, that money stays in circulation only until the principal is repaid. In an economy where private enterprise is several times greater than public enterprise, which is as it should be, the greater volume of private loans in circulation would provide a contractable secondary supply of money that could be adjusted for inflation simply by turning off the credit spigot. No need to tax anybody! When the U.S. Congress transferred their power to issue money to the Federal Reserve Bank of New York in 1913, they gave away our Nation's destiny. Without the ability to create and issue money as a credit, Congress has to resort to taxing and borrowing in order to have a revenue. If Congress had retained that power, I think they would have eventually realized that taxes and usury are unnecessary aberrations that can be abolished. But we were never allowed to evolve to that point. By de-centralizing that power and putting it into the hands of numerous public credit agencies, accountable to the People, we would have a superior mousetrap which works on this simple formula; when inflation arises, reduce the volume of lending, when recession appears, increase the volume of lending. Sweet, simple and flawless. But how do we overthrow the Beast without spilling a lot of blood? That is the hard part.

November 7, 2007 4:56 PM | Posted by: abc

You might want to check out the link in the first comment, Dugan King.

To see how hard the hard part realy is.

November 7, 2007 4:57 PM | Posted by: abc

You might want to check out the link in the first comment, Dugan King.

To see how hard the hard part realy is.