The Peak Oil Deception: Squeezing Energy for Profit

While energy needs are set to grow inexorably for the next decades, production of hydrocarbon fuels is being throttled down to a trickle. The resulting shortage finds us - the consumers of energy - at a distinct disadvantage. We are paying the price for not paying attention.

The Peak Oil scenario was first announced in 1956 by a petroleum geologist - M. King Hubbert - who was at the time working for the Shell Oil company. Hubbert's prediction was that oil production would peak in the US between 1965 and 1970 and that internationally, the peak of production would be reached around the year 2000. Hubbert's peak, as the inexorable winding down of oil production has also been named, is universally recognized as a threatening reality, but is the theory based on actual physical principles?

North Sea oil rig -

There certainly is a shortage of production and transformation, enough to have driven prices above the $100-a-barrel level for crude oil. Those oil price increases have elevated the profits of oil companies to undreamed-of heights. Shell's profit for 2007 is a record 31 billion Dollars, Exxon Mobil "shattered its own record as the world's most profitable publicly traded corporation" with a yearly profit for last year of 40.6 billion Dollars and Shevron, the second largest US oil company saw its yearly profit increase to 18.7 billion Dollars. (LA Times, 2 Feb. 2008)

The German Energy Watch Group tells us in a report released in October 2007, that Peak Oil is here now, that "world oil production has peaked in 2006". Official industry and government data on oil reserves do not support that conclusion, but Energy Watch has made its own estimates to support a result that it has been actively looking for.

Not everyone agrees that we are running out of oil. Peter Jackson, who conducted a study of world oil supplies for Cambridge Energy Research Associates says oil output will continue to rise over the next decade.

Peak Oil artificial?

My argument is that there is no actual physical shortage of hydrocarbons. There is indeed a drop in oil extraction, but it seems that this is more a forced reduction of output, rather than a consequence of having exhausted liquid hydrocarbons as a resource.

The extraordinary rise and swift fall of oil prices would tend to confirm that there was manipulation of the availability of oil on the market.

- - -

Certainly the result of going to war in Iraq was not to have more oil flowing from that country's wells, regardless of the widespread belief that Bush ordered the invasion of that country to "secure US oil interests in the Middle East". The actual result is that Iraq produces less oil than before the invasion.

Meanwhile, there are reports that oil reserves in the US are more than two trillion barrels, more than the combined total of non-US world oil reserves. The oil is combined with rock in what's called oil shale, but extraction would be more than profitable with a price tag of 100 dollars per barrel. (See The U.S. Govt's Secret Colorado Oil Discovery)

In 2000 I worked in the Gulf of Mexico for two different OSV companies that provided support services to the "oil patch". The two companies did very different work for the oil companies so I got to get an eye full.The first thing that I'd like to expose is the fact that nearly all of the new wells in the gulf are immediately capped off and forgotten about. I saw well after well brought in only to see them capped off and left. Oil or natural gas it didn't matter. I asked a couple of petroleum engineers what exactly was going on and I was told by both (they worked for different companies) that there was no intention of bringing that oil to market until the "price was right".

Dennis Meredith as quoted in Energy: Are Oil And Natural Gas Renewable?

Lindsey Williams in his book The Energy Non-Crisis tells a tale of lies and deception, a tale that suggests that the 'peaking' of US oil production some 40 years ago was less a question of lack of resources than of national policy.

There is also a series of eight videos on YouTube where Lindsay explains what he found out while a chaplain for the Alaskan Alyeska pipeline project.

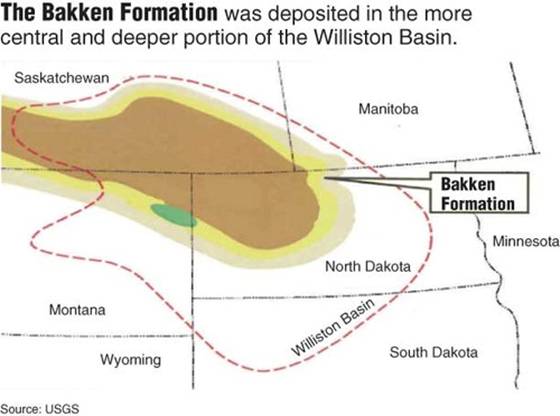

The US/Canadian Bakken oil find

The U. S. Geological Service issued a report in April 2008 that only scientists and oil men knew was coming, but man was it big. It was a revised report (hadn't been updated since 1995) on how much oil was in this area of the western 2/3 of North Dakota, western South Dakota, and extreme eastern Montana ...... check THIS out:

Source: http://bakkenshale.net/bakkenshalemap.html

The Bakken is the largest domestic oil discovery since Alaska's Prudhoe Bay, and has the potential to eliminate all American dependence on foreign oil. The Energy Information Administration (EIA) estimates it at 503 billion barrels. Even if just 10% of the oil is recoverable... at $107 a barrel, we're looking at a resource base worth more than $5.3 trillion.

"When I first briefed legislators on this, you could practically see their jaws hit the floor. They had no idea.." says Terry Johnson, the Montana Legislature's financial analyst.

"This sizable find is now the highest-producing onshore oil field found in the past 56 years," reports The Pittsburgh Post Gazette. It's a formation known as the Williston Basin, but is more commonly referred to as the 'Bakken.' It stretches from Northern Montana, through North Dakota and into Canada ... For years, U.S. oil exploration has been considered a dead end. Even the 'Big Oil' companies gave up searching for major oil wells decades ago. However, a recent technological breakthrough has opened up the Bakken's massive reserves.... and we now have access of up to 500 billion barrels. And because this is light, sweet oil, those billions of barrels will cost Americans just $16 PER BARREL!

That's enough crude to fully fuel the American economy for 2041 years straight. And if THAT didn't throw you on the floor, then this next one should - because it's from 2006!

U.S. Oil Discovery - Largest Reserve in the World

Stansberry Report Online - 4/20/2006

Hidden 1,000 feet beneath the surface of the Rocky Mountains lies the largest untapped oil reserve in the world. It is more than 2 TRILLION barrels. On August 8, 2005 President Bush mandated its extraction. In three and a half years of high oil prices none has been extracted. With this motherload of oil why are we still fighting over off-shore drilling?

They reported this stunning news: We have more oil inside our borders, than all the other proven reserves on earth. Here are the official estimates:

- 8-times as much oil as Saudi Arabia

- 18-times as much oil as Iraq

- 21-times as much oil as Kuwait

- 22-times as much oil as Iran

- 500-times as much oil as Yemen

- and it's all right in the Western United States .

James Bartis, lead researcher with the study says we've got more oil in this very compact area than the entire Middle East - more than 2 TRILLION barrels untapped. That's more than all the proven oil reserves of crude oil in the world today, reports The Denver Post.

Renewable oil

Thomas Gold says that hydrocarbons are not the result of the degradation of living organic matter from prehistoric times. In his book The Deep Hot Biosphere: The Myth of Fossil Fuels Gold presents convincing evidence that hydrocarbons are formed deep in the crustal rock of the earth from hydrogen gas transformed into methane and subsequently into liquid and solid hydrocarbons by the action of bacteria, heat and pressure.

Methane and other hydrocarbons are also found on other planets, which have never had, to our knowledge, any higher life forms that could have left the raw materials for the formation of those hydrocarbons.

According to George Crispin's article Peak Oil Theory vs. Russian-Ukrainian Modern Theory on Lew Rockwell's site, Gold's theory of continuous production of oil inside the earth's crust has been proved out by Russian deep well drilling. These wells find oil where, according to the old theory of oil as a fossil fuel, there should be none.

Joe Vialls, a former oil exploration expert, has come to the same conclusion. In his article titled Russia Proves 'Peak Oil' is a Misleading Zionist Scam he gives much more information on the discovery of non fossil oil by Russia in different oil fields by super deep drilling methods.

Other hydrocarbons

Methane or 'natural gas' is a clean burning hydrocarbon that is native to the earth. According to Gold's theory, it is the precursor of oil and indeed, methane is found together with oil. It comes out of just about any drill hole, but is normally burned or 'flared off' like it was a nuisance. Yet, there is more methane available than we could easily use.

The process of methane production and depositing has not stopped. It is going on right now. According to the article Raining hydrocarbons in the Gulf, a steady build-up of methane deposits has been observed in the Gulf of Mexico.

The ocean bottom seems to be covered with thick strata of frozen methane. All we need to do is find a way to harvest it and we have a clean burning fuel. This article - China and India Exploit Icy Energy Reserves - gives an idea of the magnitude of the unused resource:

Quote: Methane, trapped in an icy cage of water molecules, occurs in permafrost and, in even greater quantities, beneath the ocean floor. It forms only under specific pressure and temperature conditions. These conditions are especially prevalent in the ocean along the continental shelves, as well as in the deeper waters of semi-enclosed seas (see graphic).World reserves of the frozen gas are enormous. Geologists estimate that significantly more hydrocarbons are bound in the form of methane hydrate than in all known reserves of coal, natural gas and oil combined. "There is simply so much of it that it cannot be ignored," says leading expert Gerhard Bohrman of the Research Center for Ocean Margins (RCOM) in the northern German city of Bremen.

Accordingly, both China and India are developing ways to harvest the gas.

Where does that leave us?

Should we now sit back and enjoy the ride, knowing that oil and natural gas are plentiful? Hardly so. There are serious issues of pollution connected with burning hydrocarbons for energy and that is why everything possible should be done to develop energy technologies that do not rely on combustion. The bulk of our energy should come from other resources that are not combustion-based and not polluting.

Solar, wind and hydroelectric power generation are the more 'conventional' alternatives. But much research is being done by 'lone nut' inventors into other forms of energy generation. No one is getting rich with government or industry funding. As a matter of fact, most are starving back-yard experimenters who have a hard time making ends meet, not to talk about expensive laboratory equipment or help with experimentation, product development and marketing. This is the big neglected potential of our time. Perhaps no wonder, with so many billions to be made by selling those scarce hydrocarbons...

But even without help, there has been some progress. Not as much as there should be, to be sure. Check out PesWiki, a huge resource collaboratively compiled which documents those ongoing efforts. You might want to start with their "top 100" listing, but don't leave it at that. There is much more.

There are some real alternatives just over the horizon

On of the commenters (kenneth, 22 feb. 2008) to this article brought it home to me that I skimped in listing the real alternatives to oil and other hydrocarbons that are in development. I did mention PESWiki and its Top 100 energy technologies listing, which collects information about new energy production methods that are in some stage of development, but let's expand a bit on that here.

My own favorites in this somewhat confused area are

- vortex based technologies that use the energy concentrating properties of vortex flow both in water and air for harvesting energy. Two examples are given in Water Vortex Drives Power Plant- on-demand hydrogen production from water. The hydrogen economy is not taking off for only one reason: The great difficulty of transporting and storing hydrogen. Hydrogen can be produced 'on demand', by splitting water into oxygen and hydrogen. In this way, one can simply take water as fuel and bypass the storage and transport problems. The hydrogen obtained can be used to increase the efficiency of current internal combustion engines or as a stand-alone technology for energy production. Emerging technologies to obtain hydrogen from water are described on this PESWiki page.

- permanent magnet applications. The power of magnets is thought to be static and thus not available for use in energy generating applications. But much research is going into overcoming this limitation. Granted, there have been setbacks, such as the botched demonstration of Steorn, but research is quietly continuing. This PESWiki page describes various magnet motor developments.

Although these are my personal favorites, there are many other technologies being developed by huge numbers of researchers. I can't mention them all, but you can find them on the net if you just do some searching.

And yes, I do have a proposal

Tax the energy multinationals and use the money to forward this kind of research, not fusion or other never-delivering boondoggles. Let's give the small guys a break. They deserve it. And we might get some real progress on energy independence in the bargain.

See also:

Seafloor Chemistry: Life's building blocks made inorganically

Titan Has More Oil Than Earth

"Titan is just covered in carbon-bearing material -- it's a giant factory of organic chemicals," said Ralph Lorenz, a Cassini radar team member from the Johns Hopkins University Applied Physics Laboratory. "This vast carbon inventory is an important window into the geology and climate history of Titan."

If there are abundant hydrocarbons on Titan, both gaseous and liquid, that kind of tends to blow holes in the theory of oil as a fossil fuel, doesn't it?

Why Exxon Won't Produce More

. . . If you want to understand why Exxon won't produce more, it helps to listen in to ExxonMobil's presentation to analysts in New York City in early March. Halfway through the three-hour meeting, Exxon management flashed a chart that showed the company's worldwide oil production staying flat through 2012. . . .

Yet even with prices at the pump near all-time highs, Exxon isn't planning on producing any more oil four years from now than it did last year. That means the company's oil output won't even keep pace with its own projections of worldwide oil demand growth of 1.2% a year. . . .

"We don't start with a volume target and then work backwards," Instead, he said, his team examines the available investment opportunities, figures out what prices they'll likely get for that output down the road, and places their bets accordingly. "It really goes back to what is an acceptable investment return for us."-- Exxon Chairman Rex Tillerson

As if profiting from energy wasn't enough, now the insanity has spread into food: Multinationals make billions in profit out of growing global food crisis

Giant agribusinesses are enjoying soaring earnings and profits out of the world food crisis which is driving millions of people towards starvation. And speculation is helping to drive the prices of basic foodstuffs out of the reach of the hungry. The prices of wheat, corn and rice have soared over the past year driving the world's poor - who already spend about 80 per cent of their income on food - into hunger and destitution. The World Bank says that 100 million more people are facing severe hunger. Yet some of the world's richest food companies are making record profits. Monsanto last month reported that its net income for the three months up to the end of February this year had more than doubled over the same period in 2007, from $543m (£275m) to $1.12bn. Its profits increased from $1.44bn to $2.22bn. Cargill's net earnings soared by 86 per cent from $553m to $1.030bn over the same three months. And Archer Daniels Midland, one of the world's largest agricultural processors of soy, corn and wheat, increased its net earnings by 42 per cent in the first three months of this year from $363m to $517m. The operating profit of its grains merchandising and handling operations jumped 16-fold from $21m to $341m. Similarly, the Mosaic Company, one of the world's largest fertiliser companies, saw its income for the three months ending 29 February rise more than 12-fold, from $42.2m to $520.8m, on the back of a shortage of fertiliser.

Evolution of Gas, Oil and Coal

This article by Alexander Alan Scarborough which was published in ALTERNATIVE ENERGY SOURCES VI Volume 3 Wind/Ocean/Nuclear/Hydrogen, has some detail on the theory that there is an ongoing, constant renewal of hydrocarbons inside the earth. According to Scarborough, "the new energy fuels theory (EFT) explains the formation of fuels (and all matter) by the logical progression of the transformation of energy particles into atoms, into gaseous molecules, then into liquids and solids via molecular chain-building processes."

August 2008: Exxon posts record $11.68 billion profit

Exxon Mobil once again reported the largest quarterly profit in U.S. history Thursday, posting net income of $11.68 billion on revenue of $138 billion in the second quarter. That profit works out to $1,485.55 a second. That barely beat the previous corporate record of $11.66 billion, also set by Exxon in the fourth quarter of 2007.

U.S. Geological Survey: 3 to 4.3 Billion Barrels of Technically Recoverable Oil Assessed in North Dakota and Montana's Bakken Formation

The USGS Bakken study was undertaken as part of a nationwide project assessing domestic petroleum basins using standardized methodology and protocol as required by the Energy Policy and Conservation Act of 2000.

The Bakken Formation estimate is larger than all other current USGS oil assessments of the lower 48 states and is the largest "continuous" oil accumulation ever assessed by the USGS. A "continuous" oil accumulation means that the oil resource is dispersed throughout a geologic formation rather than existing as discrete, localized occurrences.

Exxon Mobil sets record with $45.2 billion profit

Exxon Mobil Corp. on Friday reported a profit of $45.2 billion for 2008, breaking its own record for a U.S. company, even as its fourth-quarter earnings fell 33 percent from a year ago. The previous record for annual profit was $40.6 billion, which the world's largest publicly traded oil company set in 2007.

With the oil price going from $50 to 150 and back down to $40, can there be any doubt that the price was manipulated with huge profits in mind? I'd say no.

Comments

February 12, 2008 8:22 PM | Posted by: Glenn Borchardt

Sepp:

Great analysis! See the comments to my blog on Bernanke at:

https://www.blogger.com/comment.g?blogID=2202092988208583550&postID=2476344476444500868

Glenn

February 12, 2008 9:52 PM | Posted by: Jeff Baker

Alternative energy is chipping away at fossil fuels on many fronts. Some say ethanol is a big threat to oil companies. They say that scientists and faculty are being paid to trash the ethanol industry. Others say that oil companies will try to take over the biofuel industry. Still others see oil companies investing in oil-rich algae and advanced processes to convert biomass into synthetic gasoline and diesel. Looking ahead, the oil and gas industry may not be the dominant source of fuel 15 years from now. What is happening on the alternative energy front is simply phenomenal. Numerous Disruptive Technologies are going to impact the energy industry within the next 5 years. It’s not business as usual, because there are new fortunes to be made. We call that competition. Oil and gas monopolies will be a thing of the past. We all know that Big Oil has been manipulating the supply of gasoline by restricting domestic gasoline refining, and by restricting global crude oil supply. There is evidence that major oil companies attended Dick Cheney’s secret energy task meeting that had a hand in planning the Iraq war. When we deliberately bombed Iraq’s infrastructure, we cut their oil production in half. That was a gift to Big Oil. It made their inventories and oil futures worth much more. That’s why our fuel is $3 a gallon at the pump instead of $2 a gallon. Over the past 25 years, as demand increased, oil companies deliberately closed refineries, so they could claim they were operating at full capacity. Instead of producing a reasonable surplus, they claim shortages when anything goes wrong, and they raise the price. Now we are vulnerable to the slightest disruption, and we are paying for it. Oil companies raise gas prices at the pump, as soon as crude oil prices go up - solely on the expectation that the next batch of gasoline will cost more. Thus, they charge you a higher price for gasoline that they made last month at the lower price of crude. This is price fixing and gouging. The impact on our trade deficit from importing foreign oil has hidden costs, since we are buying it with Federal Reserve debt instruments. Then we pay floating interest, which becomes part of the National Debt, on gasoline and diesel fuel through income taxes. To influence oil prices, Big Oil doesn’t have to lift a finger. All they need is influence in the White House. The oil men there can simply threaten to bomb Iran, a major oil producer, and the price of crude oil jumps, making oil companies richer yet. Ethanol critics complain about government subsidies, yet the subsidies we pay to Big Oil companies is 6 times higher – while they make record breaking multi-billion dollar profits. Americans are tired of supporting the oil and gas industries and being manipulated in the process. That’s a factor in the big push to replace fossil fuels. Yes, reluctantly we still need oil and gas, but right around the corner is a car that can be driven to work all week, without using a drop of gas…Future plug-ins will have small 500 to 800 cc engines and solar panels on the roof. Big Oil - don’t count on being top dog 15 years from now. Solar power and fuel extracted from algae and biomass will be King by then.

February 13, 2008 12:53 AM | Posted by: Bill Lang

Great article. So it it is not a question of Hubbards peak oil. Rather it is a question of Peak HHO Production. Can peak HHO production fend off peak oxygen level depleation? We are about to find out.

February 13, 2008 10:07 AM | Posted by: Sepp

Siegfried Tischler said (by email):

Seen this one?

http://www.youtube.com/watch?v=R7KyFF8ja7Y

Prof Siegfried Tischler and Thomas Gold - Oil is not a Fossil Fuel

(link no longer active - Sepp)

February 13, 2008 4:12 PM | Posted by: Arun Shrivastava

Sepp,

An excellent article. I have analyzed much energy data and read peak theorists, also abiotic theorists. In my paper on energy, from South Asian perspective I found that ONGC has developed method to exploit Venezuelan heavy oil. Also, someone had sent me information that an abiotic drill hole in West Bengal had yielded oil but that it was not allowed to get to a com-ops. Also, bear in mind, Kissinger was in Kolkata, warning the Marxist coalition partner of the present rag tag band of bastard Indian neoconservatives, not to work on Iran-India pipeline becoz Iran is "rogue state". More on this later. I will post my views from S-A perspective. Arun

February 14, 2008 1:07 AM | Posted by: Sterling Allan

From what I've seen in my coverage of energy, I tend to also believe that the "peak oil" notion is more artificial, to drive up prices.

The advantage to renewable energy is that the scarcity mentality has been driving the push to develop alternative solutions, and once they come in, oil will become obsolete as fuel; and an age of abundance will be ushered in, escorting out those who use oil to control the planet.

February 14, 2008 9:23 AM | Posted by: Sepp

Thank you Sterling, for giving this article a place in your Peak Oil directory on PESWiki.

Talking about scarcity, another comment by a friend in the US comes to mind, which I received by email. Michael says

Shortage is the name of the game for controlling people - create a well controlled shortage of a "necessity" (which can also be manufactured as well) and they can be controlled to a point which can easily be described as a form of slavery.

Shortages of money, food, housing, water,.....heat in deadly cold, cold in deadly heat, etc.... as well. According to a Pentagon report, there could be future wars fought over crops which could be used as food or fuel, with wealthy countries starving for fuel fighting poorer countries starving for food.

That would be an unequal fight, for sure, but not really an attractive prospect, although sometimes it seems that those who advocate decimating the human population on this planet are really toying with such ideas in a serious way.

In a later message, Michael adds

The best example of man-made perception of rarity I know of is the diamond market.

Diamonds are not rare at all. They are tightly controlled by a syndicate worldwide, and are stored raw in warehouses in Amsterdam and elsewhere. They are so plentiful as a matter of fact that at one time in Africa they were harvested by natives hired by their discoverer, whose name as I recall was Oppenheimer, wearing cans hung by strings around their necks who collected them simply by picking them up off the ground, where they sat in plain view - they didn't have to dig for them at all, and the surplus of diamonds held in storage worldwide if let onto the market would collapse the price of diamonds for years because it is so large.

Now it's oil - what next - food?

Well, food is already on the agenda as we're told we can use food crops for making "bio-fuels" - ethanol from corn and biodiesel from sunflowers and other seed crops. This is pure lunacy and will certainly lead to the next scarcity - food.

February 14, 2008 12:47 PM | Posted by: Sepp

Sterling said:

the scarcity mentality has been driving the push to develop alternative solutions

Yes, and it is ironic how - at least in this instance - greed is bearing within itself the seed of its own destruction...

February 14, 2008 5:21 PM | Posted by: Lewis Jenkins

Oil Shortage. Were you here in the early 70's when "we were running out of oil" this was a lie then and it's a lie now. I drove through the oil fields in Oklahoma during the first oil crisis. Most of the oil pumps were either turned off or were going very slow. The moment Gas got to $1 a gallon, every pump was working full time. This is not second hand information, I was there. I talked to an old friend in the oil business, and I asked Marvin are we running out of oil? He laughed and turning toward Texas and spreading his arms, stated there is enough oil right here to last this country for 500 years." Go up to far north Montana in the back country and you will see miles of capped off oil wells, yes were running of oil, no we have plenty, but it's time to turn to hydrogen and put these oil mongers out of business.

February 14, 2008 5:25 PM | Posted by: Lewis Jenkins

Also, don't ask the monster about his next meal, because it might just be you.

February 16, 2008 10:16 PM | Posted by: James Clark

Thanks again Sepp for a very informative and broad scope commentary on this very important subject. You did not mention some other goodies like Tesla's work and ZPE, but I know you would have, given the space (a book).

To those who have failed to read Gold's book, I can only say that you have missed the boat. This is a genius' primer on the subject before you can intelligently comment on Peak Oil... something that I believed in since 1975 till Gold taught me the truth.

Finally, I have been promoting your "oil tax" idea for twenty years. Unfortunately, I will not happen.

Now let me get back to my Joe Cell work. Cheers!

February 22, 2008 4:44 AM | Posted by: kenneth

i'm often intrigued when multiple arguments are used to defend a position. i would hate to be on trial for my life, and have my defense attorney come up with 15 different reasons as to why i didn't do it. the jury would have to be skeptical. all of the above seem to miss the point about what peak oil proponents believe. it doesn't matter how much oil is left, what other sources are available. there is nothing on the horizon that we can get to the market as efficiently, and as cheaply as the cheap, and easily accessible oil we have used so far. there is no infrastructure for anything else, on the scale that the world economies need. when considering the available alternatives listed above: methane hydrates, solar, biomass, oil shales, super deep drilling, etc., where will the investment come from to undertake such a mammoth effort to create a new energy infrastructure? remember this is an international financial system that is reeling from mortgage rate resets mainly in the united states, the subprime mortgage crisis. this seems like another article suggesting that "peak oil" may be a scam, but if it is not, don't worry because "All we need to do is find a way to harvest it and we have a clean burning fuel." in other words technology will save the day, and just in time. in case technology doesn't come through, there's always the "free market" solutions.

February 22, 2008 2:39 PM | Posted by: Sepp

kenneth,

I can see from your comment that I skimped on listing the real alternatives to oil for energy production that are being researched.

I have added a paragraph to the article today, to make reference to at least some of the more attractive (in my view) alternatives being worked on.

March 1, 2008 11:31 AM | Posted by: Mispotach

I think we should ask geologist engineer, how many actually are oil deposit inside earth?

Can someone post here the actual data of oil deposit? Couse we know that if oil prices is higher that means available oil on the market is lower.

thanks

March 10, 2008 12:06 PM | Posted by: Josef Davies-Coates

Hi Sepp,

I actually think you're way off the mark here.

While there may not be an actual "shortage" of oil and gas (there is still LOTS in the groud), they are certain finite in supply.

Also, it is pretty clear that demand is beginning to outstrip supply and will continue to do so.

We're not going to be running out of oil and gas anytime soon, but the days of cheap oil are already over.

March 10, 2008 12:12 PM | Posted by: Josef Davies-Coates

PS - have you seen A Crude Awakening?

http://uniteddiversity.com/crude-awakening/

March 12, 2008 11:27 PM | Posted by: Sepp

Hi Josef,

I agree that the days of cheap oil are over, but it is not because oil is finite. Demand is too high, granted, and supply is kept artificially low.

Do some research on abiotic oil.

Whether we SHOULD continue to use oil or not is an entirely different matter, and I believe we should do everything to get off oil that we can. It is polluting to burn oil, and oil can be put to good use for other things than energy.

If we were smart, we'd be investing in a crash program to get every energy alternative known to man researched and on line. Take the suppression off alt energy research and you will see we do not need oil.

Then of course we need to find a way to voluntarily restrain our use of other resources. We have only one planet, and we're putting an awful lot of stress on the environment.

We would also have to figure out how to feed the earth's population without relying, as we do today, on grains to feed cows and chickens to then eat the meat. Extremely wasteful and unhealthy to boot.

But anyway, with oil supplanted as an energy source by something that's non polluting, we could get to work on these other problems to construct a future where we have long-term sustainability.

Yes, I watched the video you linked, and I find it sadly lacking in any kind of specifics. There is plenty of speculation, but little fact. It looks to me like an industry funded propaganda piece that justifies why we're paying high prices for oil.

April 24, 2008 4:38 PM | Posted by: Wade W

I was speechless to learn that three of the top five 2007 Fortune 500 were oil companies.

Industry: Petroleum Refining

Rank Company 500 rank Revenues ($ millions)

1 Exxon Mobil 2 347,254.0

2 Chevron 4 200,567.0

3 ConocoPhillips 5 172,451.0

4 Valero Energy 16 91,051.0

5 Marathon Oil 30 60,643.0

6 Sunoco 60 36,081.0

7 Hess 75 28,720.0

8 Tesoro 128 18,002.0

9 Murphy Oil 169 14,307.4

10 Frontier Oil 462 4,796.0

It would appear to me that while the cost of crude oil continues to rise, we can take solice in the fact Big Oil profit margins remain the same.