BIBO - A Standard for Stable Currencies

BIBO - Bounded-Input-Bounded-Output is an engineering term. It comes from Control Systems Theory and signifies that any system, to be stable, must respond to a bounded input with an equally bounded output.

Our system of bank currency - the money we are using every day - has a fatal design flaw - it violates the BIBO principle. Economic instability is built in to our money right from the start. This leads to the imperative that the economy must keep expanding endlessly. We are unable to achieve sustainable economic activity, to preserve our planet's finite resources, lest we face financial collapse.

This, in short, is the situation as argued by Marc Gauvin and Sergio Dominguez of bibocurrency.org

A formal stability analysis from the standpoint of control systems theory has shown that the mechanism of interest inherent in money creation and in everyday lending practices must lead to monetary instability (inflation) and eventually to the collapse of economic activity. Adding interest to the principal of any loan to be repaid creates an excess debt that, within the confines of the economic system, can never be fully paid off, resulting in an inherently unstable economic situation.

Financial System walkthrough

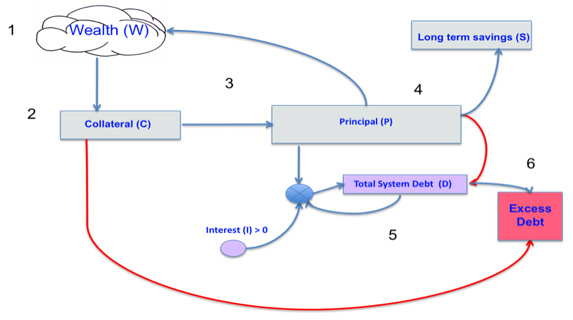

1. Wealth is generated by ingenuity, human effort and resources made available through past investment of units of currency.

2. Through the process of asset evaluation, a fixed amount of existing wealth is attributed a fixed collateral value in the form of a sum of units of currency.

3. The fixed collateral sum is used as the basis for the creation of new currency in the form of a second fixed value i.e. the principal sum of loans issued into circulation through current account entries. Since both the collateral and principal loan sums are fixed, they maintain a constant ratio to the wealth pledged.

4. Current account units are distributed back to wealth producers through purchasing transactions or may be saved or stored (at a compounding interest rate) or used to cancel debt thus reducing the total amount of money in circulation.

5. Total debt due is the principal sum entered as a negative number in a loan account to which interest is added such that the debt grows as a function of time.

6. Because the total debt created always exceeds the amount of money available to satisfy it, the system produces a minimum residual debt that must be refinanced in subsequent cycles thus compounding it.

- - -

The solution to this problem is to re-engineer, to re-think our currencies. In order to allow stable economic activity, we must use a currency that satisfies the principle of BIBO - Bounded-Input-Bounded-Output. That principle could be put into effect in local or national currencies or even in an international setting. The important thing is that we now have a standard, a specification that any currency may be structured by.

A Stable Passive Currency System - Presentation

This paper (PDF) introduces the concept of a stable currency and how to achieve it.

To round out the picture, a

Formal Specification of the International BIBO "@" Currency Specification

has been worked out by a group of scientists and engineers. The specification is published on bibocurrency.org

and is available as a PDF here:

http://bibocurrency.org/BIBO%20currency%20specification%20v4.6.pdf

In time, there may be updates and new versions of these documents, so please do refer for the latest version to what is currently linked on bibocurrency.org, rather than to the links in this article. They are current now but might be superseded by later versions.

Another pertinent paper in this connection:

Is Our Monetary Structure a Systemic Cause for Financial Instability?

Fundamental laws govern all complex flow systems, including natural ecosystems, economic and financial systems. Natural ecosystems are practical exemplars of sustainability: enduring, vital, adaptive. The sustainability of any complex flow system can be measured with a single metric as an emergent property of its structural diversity and interconnectivity; it requires a balance in emphasis between efficiency and resilience.

The urgent message for economics from nature is that the monoculture of national currencies, justified on the basis of market efficiency, generates structural instability in our global financial system. Economic sustainability therefore requires diversification in types of currencies, specifically through complementary currencies.

Comments

November 30, 2009 4:26 AM | Posted by: Tom Kasmer

The problem begins with our sending jobs off shore. The lack of a gold standard is also a factor. I would set the price of gold at $2k an ounce and freeze it there. I would also tax companies who outsourced work in the amount of the loss to the USA economy. We are spending as if we had an unlimited credit card line of credit. Last I would freeez the oil price and eliminate hedge funds. We can't afford to allow markets that could put us under to float freely. Thats insane. Tom

November 30, 2009 11:36 AM | Posted by: Sepp

Tom,

there certainly is a need for changes in the economic system, as you say.

A gold standard has its own problems. Apparently it is harder and harder to find and mine gold, so since the metal is a scarce resource, it really should not be linked to monetary matters.

It's the "spending as if there was an unlimited line of credit" that is problematic. A solution for that definitely needs to be found, or there may soon be a nasty surprise for the American people.

And yes, there is insanity in those speculative markets...

December 1, 2009 6:59 PM | Posted by: Ross

Using gold is great (any relatively rare, distinguishable, durable, and hard to counterfeit commodity is fine) but fixing its price would not help anymore than Central government bankers fixing prices helps.

Sepp's concern about scarcity is actually a plus: it's exactly it's scarcity that makes it more sensible as money. Who wants to buy a car with 10,000 loaves of bread, for example.

We need money to make markets run the way they do. The Austrians (e.g. Rothbard) said that money is NOT a 'store of value' but rather the most widely marketable commodity. That, plus its durability, its relative rarity, and the difficulty in counterfeiting it makes it a good currency. (Not "great", just good...)

Now, what about paper fiat money? Crap. It only works because you and I agree it's worth something. Ask a Zimbabwean what his paper is worth. Those poor souls are actually printing and using 100 trillion dollar bills. Not durable..easily counterfeited, etc.

Of course the major threat of counterfeiting comes from the central banks. Who counterfeit as a primary rule of business, to support their fractional reserve banking scheme.

December 2, 2009 1:00 AM | Posted by: Sepp

Since money is needed for economic activity (it mediates the exchange of goods and services) its quantity must match the size of the economy it serves.

Gold is out because its quantity cannot be easily adjusted to meet a growing economy's needs. With the quantity of gold available for monetary use pretty much stable, the growth of an economy will then reflect in the price of gold, which is ok for any old commodity, but isn't ok for money, as you lose stability of the value of your currency.

Paper money is perfectly workable. Most currencies today are paper money. The thing that can go wrong in the case of paper money is when more is made (government issues too much, banks create too much) than is compatible with the size of the economy served.

What needs to be found is a reliable way to keep the money in tune with the size of the economy. So it must be flexible (can't be limited like gold is) but it must also be disciplined...

December 8, 2009 2:41 PM | Posted by: feverzsj

Any kind of token system is just "all rivers run into the sea". The problem deep inside is that the amount of resources(money) can be acquired by individual far exceeds what he deserves. And those who control the resource are able to rule everything they want.

March 9, 2010 5:01 PM | Posted by: Mike Bird

For the life of me I can't understand why people have to keep re-inventing how money should be used.

Wouldn't it make more sense just to abolish it? Why do we really need it?

We spend so much time worrying about it, it actually takes our lives away. As long as money is around, people won't really matter. They are just the food to be consumed on the road to accumulating more $$.

October 26, 2010 1:23 AM | Posted by: mmarq

There is a simple evidence about this money theories that apparently make all wrong.

1. wealth is generated by ingenuity alright, but it is not driven by the "units" used to measure it in the markets(money), it is measured by the potential benefits it could provide and so interest of buyers (cars tagged $1B each are nothing but garbage if there is no usefulness and no one affords them)

2. the real units of currency, and the real assets are ppl, that is, consumers. Not abstract concepts... simple!

Money has no intrinsic value, its only a circulating "ACCOUNTING" memorandum of what has been drawn from a market by a consumer(expressed in an agreed measuring unit), which consumer must in a way or another re-tribute back that value, so that debits and credits balance off.

Money should be a very fixed agreed standard, not able to harbor any "interest" or fluctuate in relative "value"(no inflation), and to be able to do that "money" should be emitted by the consumer, that is, ALL OF US without any exception.

Every "consumer" should employ BIBO principals, and so the total currency in circulation reflects the sum of the individual abilities of each consumer to re-tribute back.. guarantying no more debt traps what so ever.

Attributing value to merchandise and deriving from that the total amount of money in circulation is a gross mistake leading to imbalances not much different from now, because a price tag can be on, but waste of resources and pollution and distortions in-issue because there isn't enough buyers.

January 3, 2014 9:42 PM | Posted by: stamatiskavadias

Your analysis of debt appears mistaken. Money is a flow. Suppose I lend you 100$ and expect 20$ interest (i.e., a total of 120$). Also, suppose for the example, that this is all the money that exists: 100$; there is no other money and you have to pay me 120$.

Is this possible?

Answer: it is, provided that every dollar of interest you pay me, I spend it, so that it can be eventually earned by you. Once you earn the 20$ and also you earn back the whole amount of 100$, you can repay the principal of the loan *after* you have repaid the interest. Note that, when you pay interest, the money *does not* get destroyed! Only when you eventually pay the principal, the money is destroyed.

Watch this excerpt from the animated documentary "Money as Debt II", to understand why it can be that what you say is true, but we cannot measure it so simply, as you try.

http://www.youtube.com/watch?v=1RkEGn2MXB0&list=PLWxeEQFUVyjSAbzPPWYE4lCXyGr1Fa0KQ&index=15

January 4, 2014 4:39 PM | Posted by: Sepp

I like your video stamatis.

It explains quite well why we find ourselves in this rat race.

What to do?

Reinvent money or, as Mike Bird said in a comment, just abolish it.

Well, I guess the first step is public awareness of the current state of affairs and the vid is a good step in that direction...